As of the close of Tuesday, October 17, 2023, a scan of high-volume options found ten breakouts and one breakdown candidate.

The breakouts:

BITO:

COIN:

DE:

ETSY:

PACW:

PLUG:

ROST:

SLV:

VXX:

and ENPH:

The breakdown;

Securities Trading

As of the close of Tuesday, October 17, 2023, a scan of high-volume options found ten breakouts and one breakdown candidate.

The breakouts:

BITO:

COIN:

DE:

ETSY:

PACW:

PLUG:

ROST:

SLV:

VXX:

and ENPH:

The breakdown;

As of the close of Monday, October 16, 2023, a scan of high-volume options using PerfectStorm found five breakout candidates.

AMZN:

GOLD:

HL:

SPY:

JPM:

As of the close of Friday, October 13, 2023, a scan of high-volume options found three breakouts and one breakout candidate.

The breakouts:

CPNG:

GDX:

and TSM:

The breakdown:

NCLH:

As of the close today, Thursday, October 12, 2023, a scan of high-volume options using Perfect Storm found seven breakout candidates.

AZN:

C:

CVE:

EPD:

PBR:

PSTG:

and SNAP:

Yesterday we found ten new breakouts and today, October 11, 2023, a PerfectStorm scan of high-volume options found ten new breakout candidates.

ADBE:

APLS:

ENPH:

IQ:

NFE:

QQQ:

SOFI:

SOXL:

TQQQ:

and WBA:

As of the close of Tuesday, October 10, 2023, a PerfectStorm scan of high-volume options found TEN breakout candidates.

AAPL:

COIN:

DFS:

DIS:

KWEB:

MSFT:

PTON:

TMUS:

CRWD:

and PLTR:

As of the close of Monday, October 9, 2023, there were four breakouts and one breakdown.

Ther breakouts;

AMD:

EA:

MU:

and NVDA:

the breakdown;

ZM:

As of the close of October 6, 2023, PerfectStorm found three new breakout candidates.

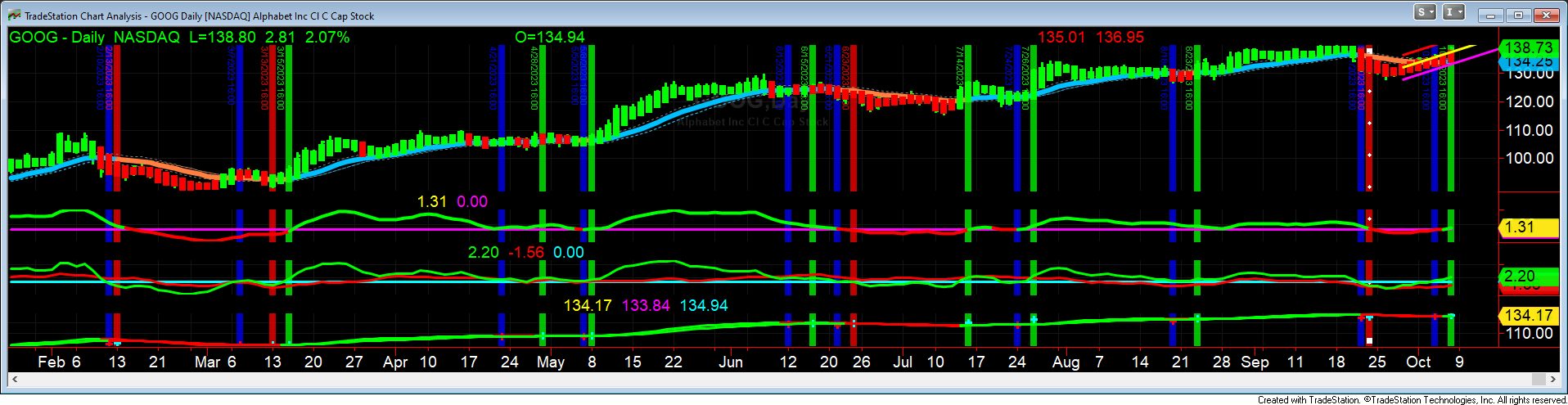

GOOG:

PINS:

and TSLA:

As of the close of Thursday, October 5, 2023, there were no breakouts and two breakdown candidates.

The breakdowns:

EEM:

and WYNN:

As of the close of Wednesday, October 4, 2023, a scan of high-volume options could find no new candidates.

The attached illustration of four high-volume ETFs will illustrate the concept of relative strength with positive momentum often will have a long candidate in spite of other markets in decline.

UUP, the dollar ETF has been in an uptrend for a few weeks with high relative strength.

Five-way Relative strength:

This is the Primary Sidebar Widget Area. You can add content to this area by visiting your Widgets Panel and adding new widgets to this area.

This is the Secondary Sidebar Widget Area. You can add content to this area by visiting your Widgets Panel and adding new widgets to this area.

Copyright © 2024 · Lifestyle Theme on Genesis Framework · WordPress · Log in