On Thursday, December 19, 2013, Target(TGT) confirmed that someone had hacked onto its systems and had stolen 40 million debit and credit cards from stores across the country. The breach lasted from Black Friday, November 29, 2013 to Sunday December 15, 2013.

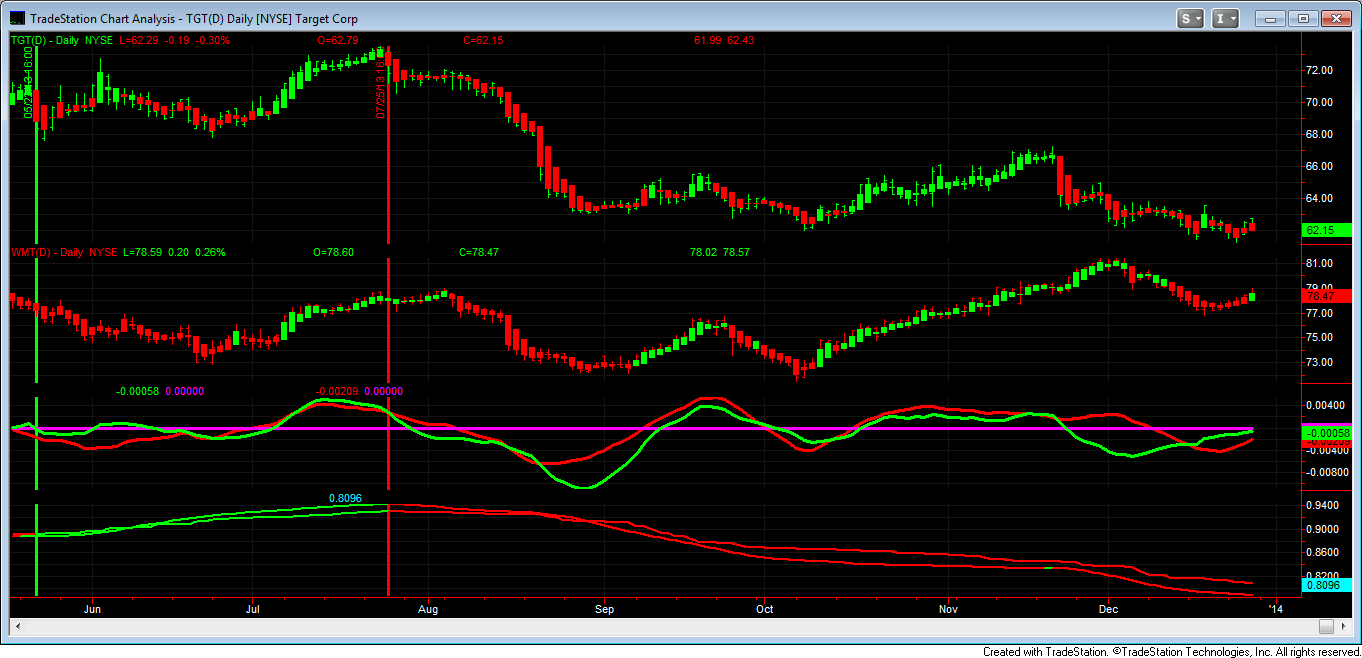

Target(TGT) has generally been ‘paired’ with Walmart(WMT) in many pairs trading strategies.

The following chart shows one such strategy, the Swingtrader method using relative momentum and NOT mean reversion.

On July 25, 2013 a signal was given and the next day WMT would have been purchased at its high price of 78.03 and TGT would have been sold at its low price of 70.55.

On December 27, 2013 the price at the close was 78.47 for WMT and 62.15 for TGT. A profit on both side of the pairs trade.

Returns would depend on what type of trader you are. It has been our thesis that generous returns are available using Swingtrader based pairs trading.