Many investors own some precious metals in their portfolios. Often times the investment is in actual coinage or bars of silver, gold, platinum, or palladium. There are exchange traded funds(ETF’s) that represent physical deposits of the commodity. GLD represents .1 ounce of gold. SLV represents one full ounce of silver. PALL is backed by .1 ounce of Palladium, and PLT is backed by .1 ounce of Platinum. The ETF’s charge a management fee. As a result, the ETF’s track the actual commodity, but do not represent the actual prices.

The Swingtrader philosophy is to trade only when you have an edge. Pairing up some of the commodities and either trading the pair or only trading the component of the pair that is stronger, will lower risk. With the pairs trade, you don’t capture the direction of the prices. you capture the outperformance of one component over the other. With the directional trade, you only go long that component that is in the upswing direction of the pair and is in a stronger upswing than the other.

The following two examples of precious metals pairs should be helpful.

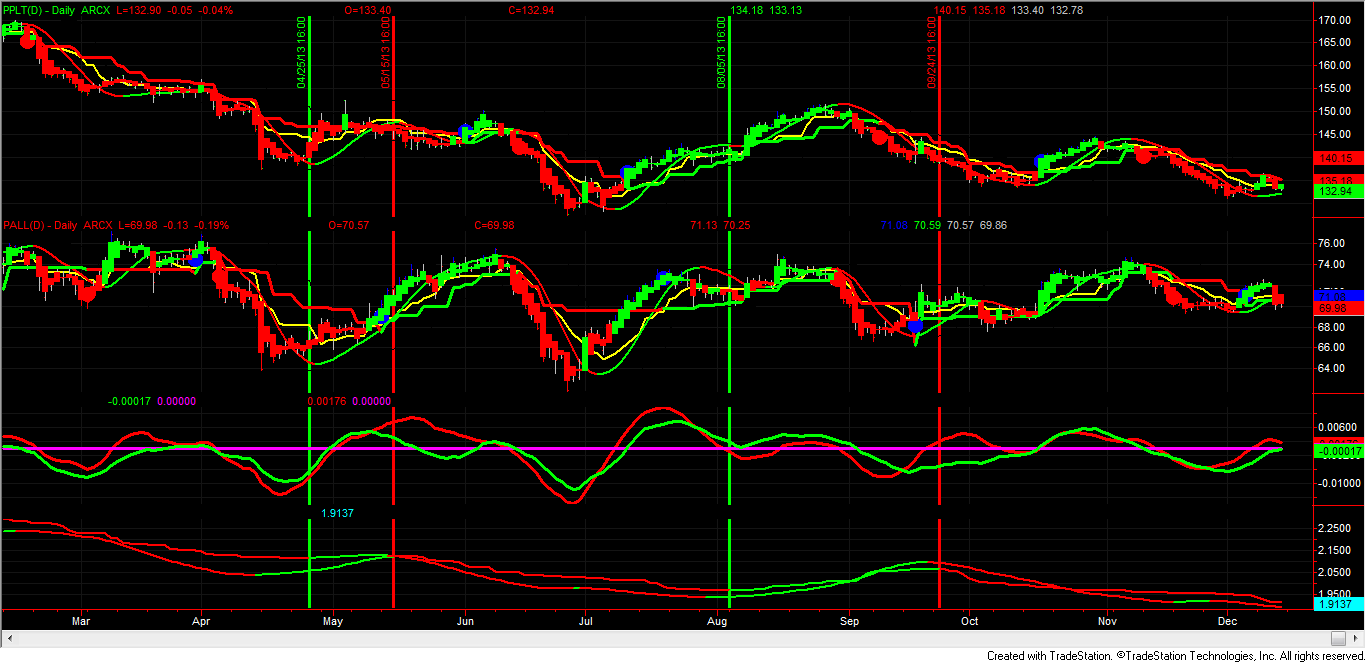

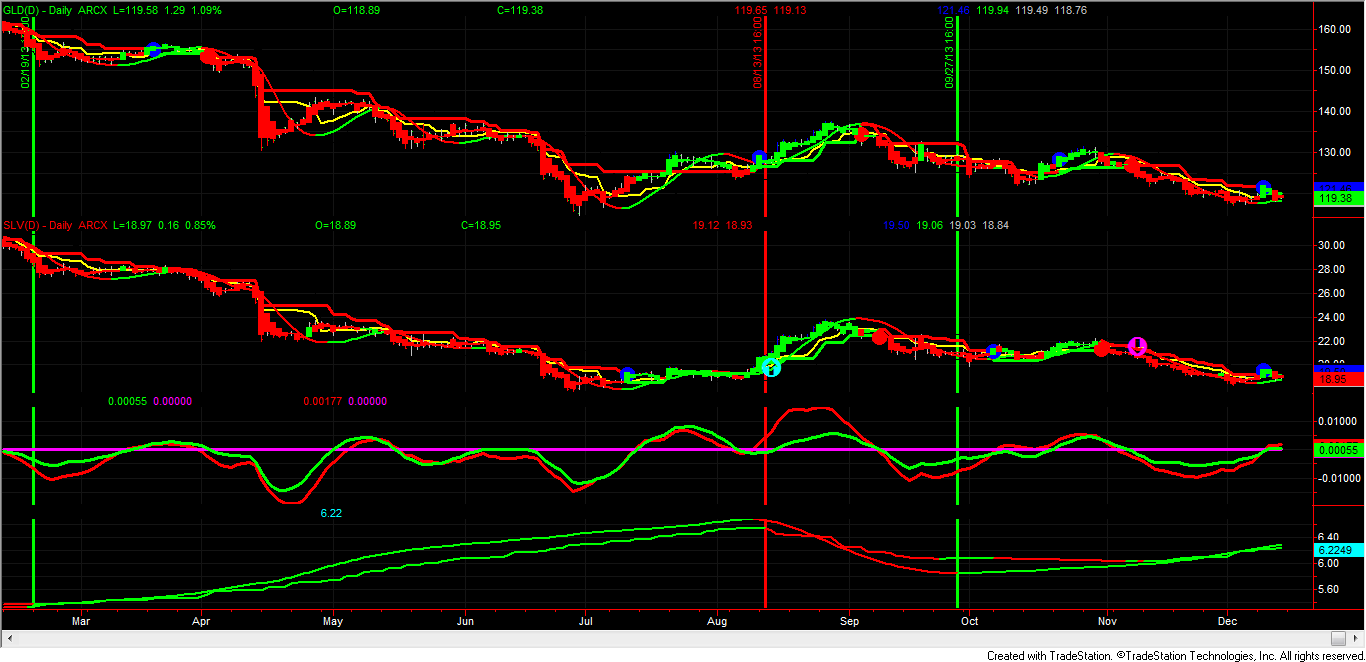

Go long the top security (green) and short the bottom(red) when the vertical line is green.

Go long the bottom security(red) and short the top security(green) when the vertical signal line is red.

A glance at the results achieved with your eye or ruler should illustrate the profitability of the pairs trade.

The first pair is Gold(GLD) (green), Silver(SLV)red

The second pair is Platinum(PPLT)green, palladium (PALL) red.