As of the close of Wednesday, August 23, 2023, PerfectStorm scan of high-volume options found five new breakout candidates and one breakdown.

The breakouts are:

CPNG:

GOOG:

NVDA*(earnings coming very soon):

PBR:

and ORCL:

The breakdown is LCID:

Securities Trading

As of the close of Wednesday, August 23, 2023, PerfectStorm scan of high-volume options found five new breakout candidates and one breakdown.

The breakouts are:

CPNG:

GOOG:

NVDA*(earnings coming very soon):

PBR:

and ORCL:

The breakdown is LCID:

As of the close of Monday, July 3, 2023, my PerfectStorm scan found 12 additional breakout candidates.

This is for information only and is not to be considered a recommendation.

CVX:

GME:

LCID:

OXY:

RBLX:

T:

CTLT:

CVE:

HBAN:

NOW:

and UBS:

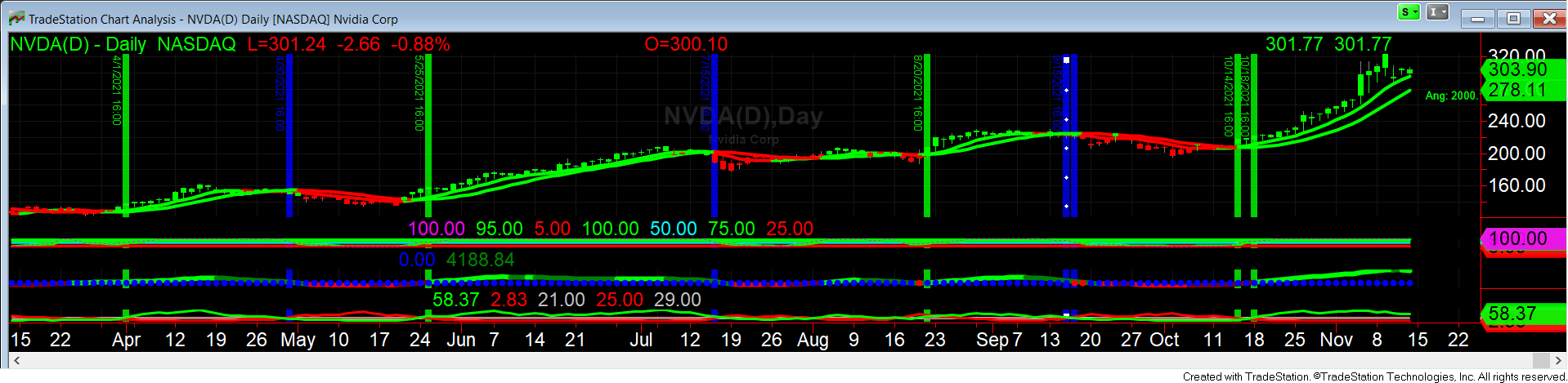

Nvidia turned up as successfully passing the better than average Clean Surplus ROE sometime in 2016 when the share price was under $25. As of the close on Friday, November 12, 2021, it was at 303.50. On May 28, 2021, the weekly signaled a purchase under $160. The daily trade trigger signaled a purchase most recently on October 14, 2021, at a price less than $217. NVDA is one of the many high-quality shares that could be in a Swing Trading portfolio. Buy when both the weekly and daily agree. Stay on the sidelines during periods of disagreement.

This is the Primary Sidebar Widget Area. You can add content to this area by visiting your Widgets Panel and adding new widgets to this area.

This is the Secondary Sidebar Widget Area. You can add content to this area by visiting your Widgets Panel and adding new widgets to this area.

Copyright © 2024 · Lifestyle Theme on Genesis Framework · WordPress · Log in