Mastering the Art of Swing Trading: A Comprehensive Guide for Successful Traders

Beat the market odds with Swing Trading

When I was a young boy, my mother often would send me to the bakery a few blocks away to buy sliced rye bread. I would enter the shop and ask the person behind the tall counter for sliced rye bread, please. They would take the bread off the shelf and put the bread into a bread slicer that looked like a wire cradle. I looked it up on the internet recently and it looks like the Berkel Model MB. The machine would shake a bit and in a few seconds, the bread would be sliced. I thought then and I think now, that it was an elegant solution. The expression “The greatest thing since sliced bread” still rings true. Recently I discovered what this greatest thing is, it’s called Swing Trading.

What is Swing Trading?

Somewhere between the worlds of day trading and trend trading lays the land of swing trading. Much like day trading, swing trading depends upon short-term changes in stock prices, but offers an easier investment style for those who don’t have a schedule that allows for trading during the day. Where a day trader may make several trades in a single day, a swing trader holds stock for days before selling. Swing traders generally hold positions for a single day to thirty days. Sometimes, swing traders may hold positions for longer periods, months, or even years, depending on changes in the market sectors, but the main goal of swing trading, like day trading, is to capture those short-term market gains.

While day trading requires a constant presence at a computer during market hours, an impossible requirement for some, swing trading offers a short-term option that provides flexibility. Traders still need to be vigilant to avoid missing sudden price explosions or drops, but success isn’t based on the type of near-instantaneous trades that fuel day trading. You can be away from the market for hours or days and still profit from your trades.

Versus Day Trading

At one time, day trading was a profitable trading style, but high-frequency trading algorithms have changed the way trading is being done. Some surveys estimate that over 60% of all trades done in 2023 are a result of high-speed trading algorithms. It’s becoming increasingly difficult to make gains with the quick trades that characterize day trading without the use of robust trading platforms and systems.

Versus Trend Trading

Trend trading, also known as buy-and-hold, is the strategy most favored by individual investors. The advantage of this strategy is that it takes very little effort to make an initial purchase decision. Positions in a multiple stock portfolio are held for months, years, or even decades. Most investors make the decision to buy and forget about the individual stocks in their portfolio because they expect their selections to make them money over time.

At least, they forget about their stocks and portfolio until the overall market goes into severe decline and they have lost 20-50% of their original investment value as happened in the years 2007-2009.

With swing trading, you don’t leave your investments on hold. You build your portfolio a few days at a time by buying and selling according to the trends, making gains with each trade.

A Strategy That Works

If you want to succeed at swing trading, you need to go into it with the right frame of mind for the trading style. Swing trading isn’t about stock value over the long term, or a company’s success. Future prospects and future stock values of the company don’t matter. The company’s business plan and products don’t matter. The financial history of a company doesn’t matter. Looking at those types of economic fundamentals and technical indicators is for trend traders, not for swing traders. Successful swing trading is solely about the study of a stock’s pricing patterns.

To be successful as a swing trader, it’s essential to know three things:

- When to buy.

- What to buy.

- When to sell

When to Buy

If you have ever visited an organic grass-fed dairy or a cattle farm, you have likely seen a system called intensive rotational grazing, even if you didn’t know you were seeing it.

Intensive rotational grazing is the process of moving a herd to a fresh pasture in order to give the previous pasture time to recover from the cow’s previous grazing. Though the farmer sets up the paddocks and opens the gates between them, it’s the cows who seek out the fresh grass.

It’s the instinct of the herd. One cow sees tasty new grass through an open gate and grazes its way into the fresher pasture. When the other cows notice that the first cow has found better grazing ground, they follow the first cow to the new pasture. There is no planning or coordination for the movement of the cows. Each individual member of the herd chooses to move based on the movement of the rest of the herd.

The control member of the herd (the first to spot the new grass) doesn’t deliberately take on this role, and it can’t predict that the rest of the herd will follow, but the result is the same. All the cows eventually end up in the new pasture.

This type of herd mentality occurs in the stock market as well. The economic field of behavioral finance refers to this market phenomenon as mimicry. Basically, where one trader goes, you can expect others to follow. As soon as those traders start to trickle into a sector, it’s a good time to buy in that pasture.

What to Buy

If you spent enough time on that farm, you might have noticed that, just like with humans, some cows have more influence than others. Maybe one cow always notices the new grass first or is just the type of cow that other cows want to follow. Whatever it is about that cow, you can tell that particular cow is a leader.

Successful swing trading depends upon finding the leading cow or cows in the pasture, or the leading companies that control a market sector.

When to Sell

There is an old New England expression: A rising tide lifts all boats.

What goes up must come down, and if a rising tide lifts all boats, a falling tide must lower those boats.

You want to buy as soon as you notice the herd moving into the pasture, and you want to get out before all of the good grass is gone. To get more fresh grass, you need to be one of the first cows in when the new pasture opens and one of the first cows out when the grass gets low.

Boat or cow, gains depend upon acute observation skills. The cow must notice the next open gate.

For successful swing trading, you must notice the receding waters of the sector in which you trade as quickly as possible and get out while the tides are still near their peak. You also must notice when a gate has opened to a new pasture and get there before the rest of the herd eats all of the good grass.

Swingtrader.com will help you recognize these trends as they happen. Our indicators will signal changes in the overall market, in market sectors, and in individual market shares.

With Swingtrader.com, you will learn how to read the signs that the tide is rising in a sector. You will learn how to determine which companies are leading the herd. You will learn to feel the change of the tides and notice when the next gate opens.

When you know when to buy, what to buy, and when to sell, success in swing trading becomes almost unavoidable. All that matters is not losing money. If you use the Swingtrader mindset you can eliminate the losing trades. The winners will take care of themselves.

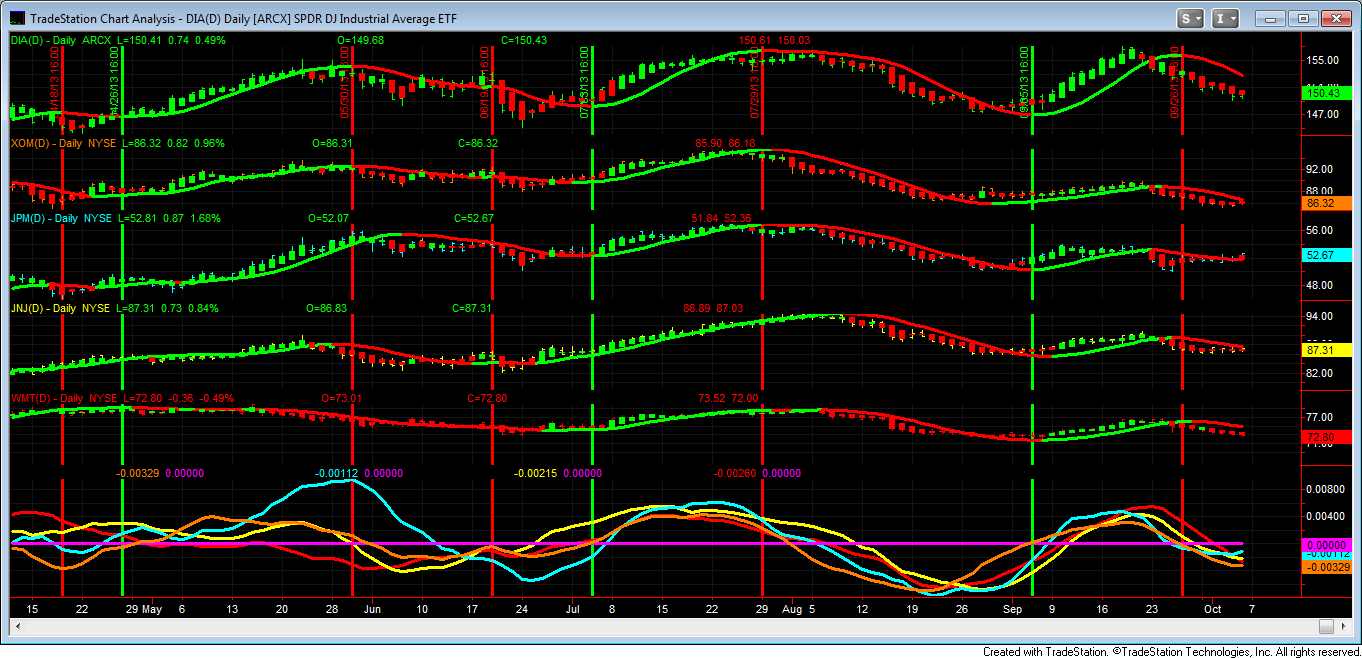

The indicators on these charts are part of The Perfect Storm Trading Strategy. This strategy offers the trader a house advantage similar to playing Blackjack knowing what the high card count is and using expert strategy. In Blackjack, when there is an abundance of ten-count cards remaining in the shoe, the player has an advantage. For more information on The House Advantage please read the book of that title by Jeffrey Ma, one of the M.I.T. team that used a house advantage strategy to win extraordinary sums at various casinos. Perfect Storm uses a similar house advantage. It waits for the various signals to line up so that there is an inescapable conclusion and time to act. Once the signals realign in a different manner, it is time to close the position. Just like the M.I.T. strategy, the Perfect Storm Trading Strategy only pulls the trigger when the odds are in its overwhelming favor.

The following chart gives an example of what I believe to be the best way to secure the house advantage.

The market direction is represented by the symbol DIA, which is the Dow Jones Industrial Average exchange-traded fund(ETF). Although the ‘Dow’ contains only 30 stocks, the index is constructed to reflect the market behavior of the industrial sector of the U.S. economy. The components of the index are some of the largest industrial companies in the United States traded on a regulated stock exchange. The DIA ETF is on the top of the chart and the trend direction is represented by the red and green vertical lines. When the trend is up, the line changes to green. When the trend is down the trend, as determined by one of the PerfectStorm indicators, the line is red. The date of the chart is as of the close of October 4, 2013.

The other securities on the chart from top to bottom are components of the DIA. Exxon Corporation(XOM) in orange, JP Morgan Chase (JPM) in teal, Johnson & Johnson(JNJ) in yellow, and Wal-Mart Stores (WMT) in red. These securities are also represented in the bottom portion of the chart by their corresponding colors which fluctuate above and below a solid horizontal purple line. The various colored lines represent the relative momentum strength of XOM (orange), JPM (teal), JNJ (yellow), and WMT (red).

The swing trader strategy is to buy when the DIA is going up AND the component is also going up as another PerfectStorm indicator shows, AND that component also has positive relative momentum. The position would change as shown by the PerfectStorm indicators.

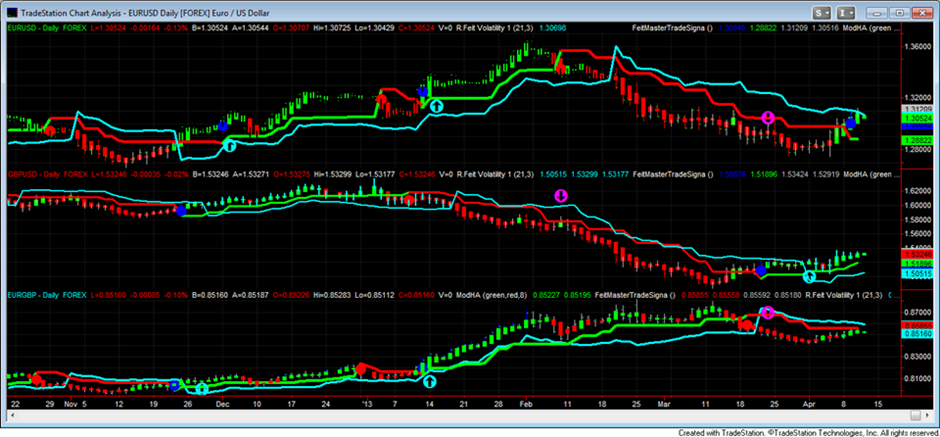

Another example of the house advantage mindset of swing trading is found in the foreign exchange market.

The foreign exchange market is the largest trading market worldwide. It is open 24 hours a day starting at 5:00 p.m. New York time on Sunday evening and stops at 5:00 p.m. New York time on Friday. Trading begins in Sydney and moves through Tokyo, Geneva, London, and New York times zones. It has a trading volume larger than all the other trading markets in the world combined. The Forex market is dominated by the large money center banks that are executing orders from thousands of industrial companies. The major currency is U.S. Dollars which make up over 80% of one side of each trade. The market, although centered on New York time, is dominated by the dealers and banks in London where the largest percentage of trades are done. The major currency pair by volume is the EURUSD.

Currencies are traded as a pair that is you sell one to buy the other. In the case of EURUSD and you are long, you are selling the US Dollar to buy the Euro. The front part of the pair, in this case EUR (Euro) is the base currency that you are either buying or selling. The back part of the pair USD (US Dollar) is the counter currency. The pair is quoted in terms of the counter currency needed to get one unit of the base currency. If the EURUSD is at 1.30, it means that 1.30 US Dollars are needed to buy 1.00 Euros.

Now that we have the basics described, how do we trade the EURUSD with a trade advantage?

There are other Forex pairs that trade in a similar manner to the EURUSD. The British Pound, GBPUSD, trades in almost the same direction as the EURUSD as their counter currency is the same US Dollar. Generally when the US Dollar is rising, getting stronger against other currencies, the Pound and the Euro react most often in the same direction. When the U.S. Dollar is getting weak usually both the Pound and the Euro are getting stronger, going up.

The house advantage swing trader knows that there is a contract that contains the Euro and the Pound, EURGBP. This is the edge that puts your decision on whether to be long or short in a bright light.

The EURGBP is referred to as a cross. Its value is almost 100% dependent on the values of the EURUSD and the GBPUSD but its direction can provide a big clue as to the relative strength of each of the major pairs EURUSD and GBPUSD.

If there is a buy signal for both the EURUSD and the GBPUSD, look at the EURGBP cross. If the cross is trending to the downside, then the EURO, the forward end of the pair is weaker. The smart trade would be long the Pound GBPUSD and not the EURUSD.

If there is a sell signal for the EURGBP cross, then you would be short the Euro if there was a corresponding sell signal for the EURUSD or long the Pound (GBPUSD) if there was a buy for the GBPUSD.

The following chart of the EURUSD, GBPUSD majors and the EURGBP cross should show this better.

The idea is to only trade when you have a house advantage.

The chart above shows that on December 3, 2012, the EURGBP showed a positive trend. On that date, the EURUSD also showed a positive trend. The same trend was also shown on January 14, 2013, and a positive trend indicated a long position on that date in the EURUSD. When that trend changed, you would have closed that position and taken a short position in the GBPUSD as indicated by the down arrow. Remember a positive trend in the EURGBP which occurred near January 14, indicates long EUR, short GBP. A negative trend in the EURGBP which occurred in late March, indicates long GBP, short EUR.

Only trade when you have a demonstrative house advantage.

Long equities when the equity market is in a positive trend.

Long or short the appropriate major currency only when the cross indicates.